Similar Posts

Why we’re BULLISH Uber?

Uber’s stock currently trades about 35% below its initial public offering (IPO) price of $45. The bulls retreated as the pandemic temporarily disrupted its ride-hailing business, while formidable competitors like DoorDash challenged its Uber Eats food delivery segment. Its lack of profits also made it an unappealing investment as interest rates rose. However, Uber divested its Southeast…

Members Only

[ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”reg” ihc_mb_template=”1″ ][/ihc-hide-content]https://www.cnbc.com/2023/01/31/why-amd-is-faring-much-better-than-intel-in-the-same-tough-economy.html AMD and Intel are fierce competitors in a difficult market for chips, but one has a much brighter short-term outlook than the other. While Intel is expecting declines across the board, AMD’s data center business is growing with the introduction of a new chip, and its pandemic-era acquisition of specialty…

How To Find The Best Edges For Trading

Traders must find trading edges to survive. Amateurs and newbies are easy targets for vultures in the financial markets. We discuss trading edges here. Trading edge: How to find an advantage in trading? A trading edge gives you a competitive advantage. Tradingsreal money and gaining experience, strolling and thinking, being systematic, reading websites, and talking…

Introduction to ESG Investing

ESG investing, which stands for Environmental, Social, and Governance, has emerged as a leading approach for investors who are looking to make a positive impact on the world while also seeking financial returns. This form of investing focuses on companies that adhere to certain ethical and sustainable practices, ensuring that they are not only profitable…

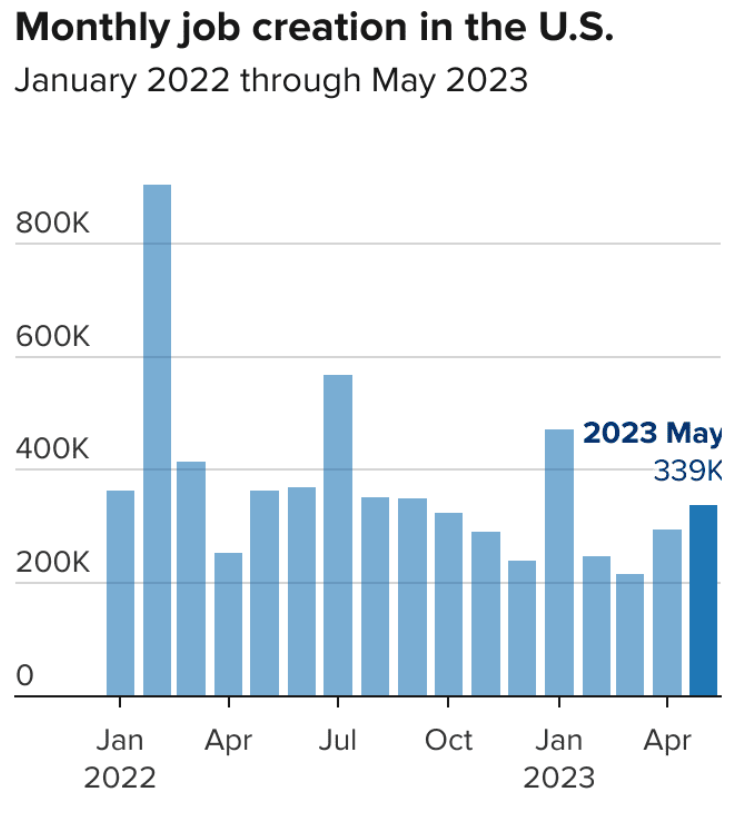

US Jobs Report Up – What Does This Imply for the Economy?

In May, the United States saw an impressive jump in hiring with 339,000 jobs added, far surpassing expectations. This points to a continuing vibrant economy, which the Federal Reserve is making attempts to slow down. The latest report issued by the authorities on Friday demonstrated the job sector’s durability in spite of the Federal Reserve’s…

The Holy Grail Trading Strategy

Many traders search for the trading equivalent of the holy grail but leave unsatisfied and disheartened. There is no perfect trading method, so let’s state that right now. The totality of many trading approaches may be considered the trading equivalent of the proverbial “holy grail.” There is no one plan that always works, and there…