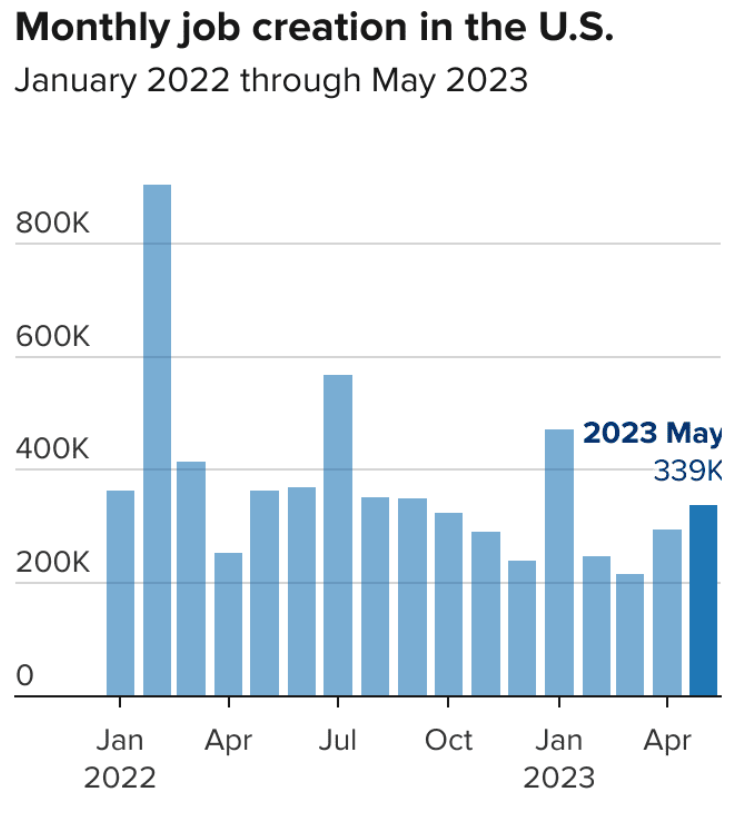

US Jobs Report Up – What Does This Imply for the Economy?

In May, the United States saw an impressive jump in hiring with 339,000 jobs added, far surpassing expectations. This points to a continuing vibrant economy, which the Federal Reserve is making attempts to slow down.

The latest report issued by the authorities on Friday demonstrated the job sector’s durability in spite of the Federal Reserve’s active raising of interest rates. Numerous industries, ranging from construction to health care and restaurants, are recruiting staff to meet consumer demand and return their personnel numbers to pre-pandemic levels.

The overall assessment of the labor market situation appears to be positive, however the May data contained some conflicting figures. Notably, the rate of unemployment increased to 3.7%, which is the highest since October, up from a 50-year low of 3.4% in April. It is important to note that the government uses two separate surveys to compute unemployment and job growth, and they occasionally contradict each other.

Does the addition of 339,000 jobs indicate that the labor market is strong?

It appears that the outlook is positive; employers added a large number of jobs in May, the most since the start of the year. However, there are indications that the pace of hiring is slowing compared to the tremendous levels of the last two years.

If youd like to trade statistical edges please review the information for Morning Hedges services at https://morninghedge.com/services/

The length of the average work week has dropped to 34.3 hours from 34.4 in April, a difference that economists have declared equivalent to thousands of job losses. This slight decrease in hours will also lead to reduced paychecks. Compared to twelve months ago, the average work week is now lower than 34.6 hours.

In May, the growth of hourly wages decreased, demonstrating that many firms are not as eager to offer higher compensation in order to attract and retain staff. The average hourly wage rose by 4.3% compared to the year prior. This is a decrease from the prior year’s incredible gains of almost 6%.

The unemployment rate had increased, likely due to the numerous layoffs from banks, tech firms, and media companies; with many of the recently laid-off workers being unable to find new jobs.

Are there signs that the economy is about to enter a recession?

It is unlikely that a recession will occur in the near future. The consistent job growth of the past months illustrates that the economy is in good shape in spite of the Fed’s increased interest rates, which have made borrowing considerably more expensive for both businesses and individuals. According to numerous economists, the onset of a recession is much further away than they had expected.

Joe Brusuelas, the chief economist of RSM, declared that as long as the economy is creating more than 200,000 jobs per month, it is unlikely to fall into recession.

The hiring of more workers in the U.S. means that more people will be receiving salaries, which implies that there will be a steady rise in the consumer spending that is the major contributor to the economic growth of the country.

IS THE ECONOMY OUT OF THE WOODS?

It may not be the case. A few warning signs have appeared in the economy’s base. Home purchases have dropped. A gauge of industrial performance showed that manufacturing has been shrinking for seven consecutive months.

Proof of greater stress from rising prices can be seen in the American populace. In the first quarter of the year, the number of people having difficulty paying credit card bills and auto loan payments increased, according to the Federal Reserve Bank of New York.

A decrease in sales across various retail outlets, including Dollar General and Macy’s, suggests that lower-income shoppers are struggling to stay afloat due to rising prices.

The Federal Reserve is striving to control inflation by continuing to raise interest rates, resulting in increased costs associated with mortgages, car loans, credit cards, and corporate borrowing. This poses a continuing threat to consumers and businesses.

Jerome Powell, Chair of the Federal Reserve, has expressed optimism that the Fed’s rate hikes will not bring about a recession, though it is anticipated they will lead to a decrease in inflation and an increase in unemployment.

Kathy Bostjancic, chief economist at Nationwide, observed that the current strength in employment delays a possible recession but does not take away the possibility altogether. She added that if the economy is too hot to moderate inflation, the Federal Reserve could just raise interest rates, which would lead to recessionary conditions.

What impact could this have on the Federal Reserve’s strategy concerning interest rates?

At the start of the week, senior Federal Reserve officials made it known that they have no intention of raising interest rates at their June 13-14 gathering. This will give them the opportunity to judge the effects of their prior rate hikes on the economy’s inflation dynamics.

In March of 2022, the Federal Reserve raised its key rate by a significant 5%. This brings the rate up to 5.1%, the highest it has been in 16 years. Changes to the rate usually take some time to have an impact on inflation and job growth.

Some within the Federal Reserve may be discomfited by the sudden surge of hiring in May and consequently push for another rate hike this month. Still, economists state that the recent increase in unemployment and minute decrease in wage growth should be sufficient evidence for the Fed to keep the rates unchanged.

What were the contributing factors to the increase in the unemployment rate?

Each month, the government’s jobs report is determined by two distinct surveys. One of these surveys focuses on businesses and is employed to determine the number of new jobs created (or lost). The other survey, which looks into whether people have been paid for any work they have done in the past month, is used to calculate the unemployment rate.

In May, the two surveys rendered diverse outcomes, with households indicating a job depletion and the survey of businesses indicating a notable increase. Even though the two surveys can occasionally vary in the short term, they usually result in comparable figures in the long run. The survey of companies is larger and usually seen as more dependable, even though the household survey is often better at pinpointing changes in the economy.

The divergence in the reported numbers can partly be attributed to the drop of 369,000 in the number of self-employed individuals between April and May. This is because the survey of households takes into account the number of self-employed workers, while the survey of businesses does not.

Matus, chief economist at MetLife Investment Management, warned that the elevated joblessness rate in May may be an indication of a forthcoming weakness. This implies that employers are likely to be more guarded when it comes to recruiting.

Matus pointed out that unemployment increased for teenagers, disabled individuals, and people who have not achieved higher levels of education in the prior month. This phenomenon demonstrated that companies were releasing employees with fewer abilities and less background, which is a typical prelude to economic downturns.

Matus pointed out that, previously, it was thought that a rising tide would benefit all, but now it appears that only a select few are able to take advantage of the conditions, as boats seem to have become smaller.

Who is in control of the recruitment?

A broad range of industries experienced job growth in May. Construction, transport, hospitality, public sector, medical, and fields such as engineering and architecture all saw increases in employment.

A plethora of industries are attempting to bring back their personnel to the numbers they had prior to the pandemic. For illustration, restaurants are having a high demand, but the number of employees is still lower than before the pandemic.

Last week, Red Bay Coffee welcomed a new employee, Mikala Slotnick, to their Berkeley, California, store. Slotnick, 21, had previously been employed by bigger coffee companies, but decided to join Red Bay because of their dedication to partnering with growers from abroad.

“It appears they put more emphasis on the production of their work rather than the money,” she commented. “I find that to be much better.”

The use of face masks has become increasingly widespread as a means of controlling the spread of the COVID-19 virus. Wearing a face covering has become a common practice, with many people donning masks to help protect themselves and those around them. This is due to the fact that the virus can be spread through the transmission of droplets expelled when an infected person talks, coughs, or sneezes.

READ MORE: